Contextually this is actually a real example from a past client of mine, with the same and some figures modified. Using a projection for a company we will call ABC, Incorporated (see below) return measurements will be described in terms of their calculation procedures and the insight they provide into investor returns.

Accordingly, tools are being developed which attempt to measure the social return on investment. The finance world has responded by embracing the idea of measuring the social benefit to be derived for various business ventures and investments.

The twenty-first century has ushered in an era of increased focus on areas such as sustainability, limited environmental impact, and social responsibility. Other measures look to provide a return for an entire project or venture. Returns can be going concern measurements calculated monthly, quarterly, or even annually. It is also important to be sure the same measurement is being used to evaluate multiple investments: differing tools can result in apples to oranges comparisons. Ultimately, whatever measure is used, it is imperative that investors understand what the measurement is evaluating.

#RETURN ON INVESTMENT HOW TO#

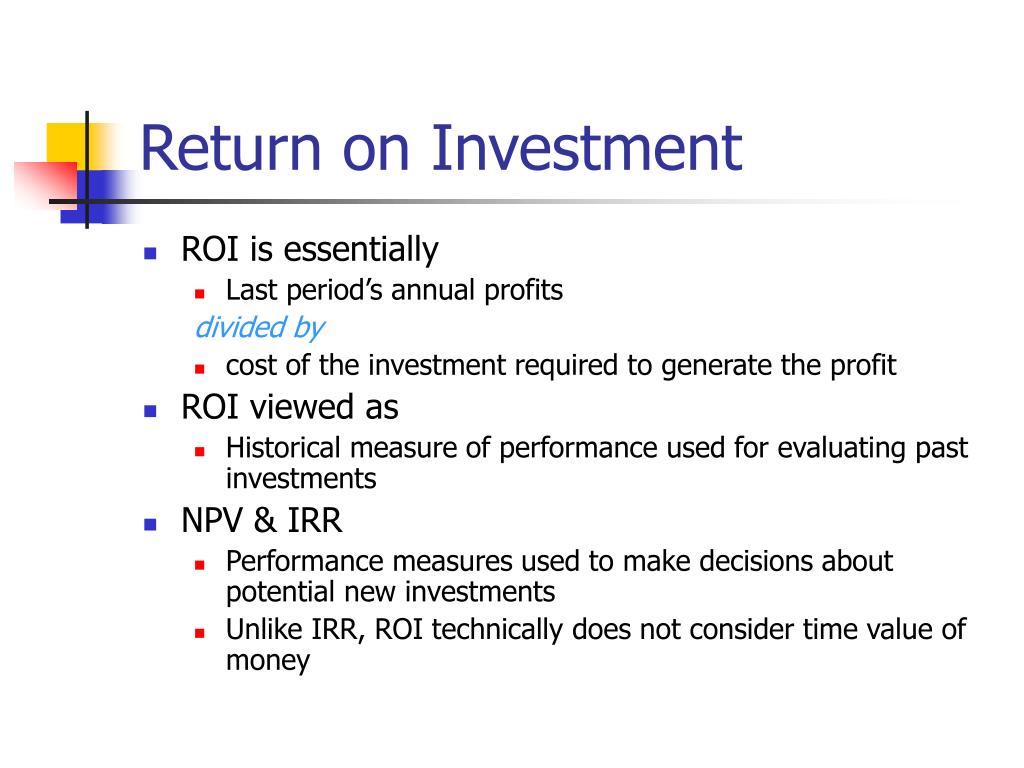

Sometimes the choice of how to measure return on investment is determined by investor preference, and in other cases, it’s driven by standard operating procedures within an industry. Return on investment is not a necessarily a measurement itself, on the contrary, it is more a category of measurement tools designed to provide insight into the operational results of an investment or business venture.ĭifferent investors choose different measures by which they evaluate operational performance. However, more often than not the actual response will be “It depends”. Upon completion of a financial projection for a new project, the first question asked is often, “What’s my return?” The anticipated reply is a simple percentage or an empirical value representing projected profits. This, benchmarking amongst peers is a critical activity for holistic performance measurement. Returns are measures not only of a venture's performance, but also a measure of one firm to another.ROA and ROIC, in particular, shed light on how a venture will be profitable.

For debt investors, financial stability is key, making the Going Concern Measures an important metric for them to monitor, to ensure that the performance of the business is maintaining itself and/or improving.The former to monitor returns from the initial investment and the latter, because a going concern return such as ROE will provide strong indications towards an exit route for the business, for example via IPO. Equity investors' main focus is typically IRR and ROE.At a minimum, all return calculations should be made, as they are useful and insightful to different types of investors in a venture.You should always first check whether or not this is the case for your own organisation. Many government organisations have formulated their own social return policies. Other options include setting special terms and conditions of performance, the inclusion of award criteria, or the reservation of a contract with sheltered employment companies. Bidders undertake to spend a given percentage (5% is regarded as the target rate) of a contract's wage bill, for example, on employing people who are disadvantaged within the labour market. Social return is often implemented in the form of a contract provision. Social return is not intended to supplant existing jobs.įurther details: Social return explained Getting started with social return

By creating additional jobs in this way, the target group can participate according to their ability, making use of extra productivity that would otherwise remain unused. These include the long-term unemployed, people who are partially disabled or young people with a disability. Organisations that adhere to the principle of social return reach purchasing agreements with contractors concerning the creation of additional jobs, work experience jobs, or internships for people who are disadvantaged within the labour market.

0 kommentar(er)

0 kommentar(er)